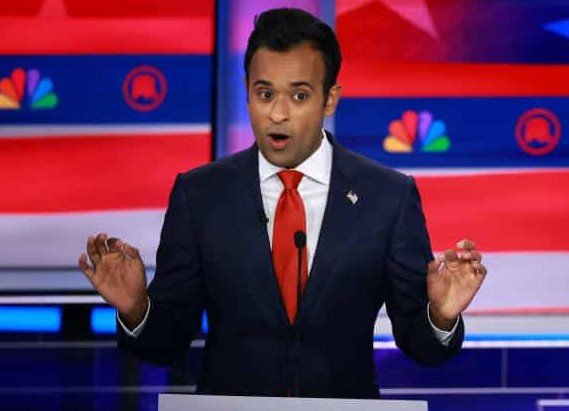

Vivek Ramaswamy, former US Republican presidential candidate, has strongly criticized the current state of cryptocurrency regulation in the United States, labeling it as “anti-American at its core.” In a recent interview, Ramaswamy argued that the existing regulatory framework, characterized by “regulation by enforcement,” creates an unfair environment for crypto firms and stifles innovation. He emphasized the need for clear and consistent regulations to foster growth and maintain America’s competitive edge in the global crypto market.

The Case Against Regulation by Enforcement

Ramaswamy’s primary criticism of the current regulatory approach is its reliance on enforcement actions rather than clear guidelines. He argues that this method creates uncertainty and fear among crypto firms, hindering their ability to operate effectively. According to Ramaswamy, the lack of clear rules means that companies often find themselves in violation of regulations they were unaware of, leading to costly legal battles and fines.

This approach, he contends, is fundamentally un-American because it undermines the principles of fairness and transparency that are supposed to underpin the country’s legal system. Ramaswamy believes that a more transparent regulatory framework would not only benefit crypto firms but also protect consumers by ensuring that all market participants understand the rules and can operate within them.

Ramaswamy’s stance is that the current regulatory environment is driving innovation away from the United States. He warns that if the country does not adopt a more supportive regulatory framework, it risks losing its position as a leader in the global crypto market. This, he argues, would have broader economic implications, as the crypto industry represents a significant growth opportunity.

The Need for Clear and Consistent Regulations

Ramaswamy advocates for a regulatory framework that provides clear and consistent guidelines for crypto firms. He argues that such a framework would foster innovation and growth by giving companies the confidence to invest and expand their operations. Clear regulations, he believes, would also attract more investment into the sector, as investors would have greater certainty about the legal environment in which they are operating.

He points to other countries that have adopted more supportive regulatory frameworks for crypto, arguing that the United States should follow their lead. By providing clear rules and reducing the reliance on enforcement actions, Ramaswamy believes that the US can create a more favorable environment for crypto firms and maintain its competitive edge in the global market.

Ramaswamy also emphasizes the importance of involving industry stakeholders in the regulatory process. He argues that regulators should work closely with crypto firms to develop rules that are both effective and practical. This collaborative approach, he believes, would lead to better outcomes for both the industry and consumers.

The Broader Implications for the US Economy

Ramaswamy’s critique of the current regulatory approach extends beyond the crypto industry. He argues that the reliance on enforcement actions is symptomatic of a broader problem in the US regulatory system. This approach, he contends, creates uncertainty and stifles innovation across various sectors of the economy.

He warns that if the US does not adopt a more supportive regulatory framework, it risks falling behind other countries in terms of innovation and economic growth. This, he argues, would have significant implications for the country’s long-term economic prospects. Ramaswamy believes that by adopting clear and consistent regulations, the US can create a more favorable environment for innovation and maintain its position as a global economic leader.

Vivek Ramaswamy’s critique of the current state of crypto regulation highlights the need for a more transparent and supportive regulatory framework. By providing clear guidelines and reducing the reliance on enforcement actions, he argues that the US can foster innovation, attract investment, and maintain its competitive edge in the global market.

Bitcoin

Bitcoin  Ethereum

Ethereum  Solana

Solana  Cardano

Cardano  Sui

Sui  Chainlink

Chainlink  Avalanche

Avalanche  Polkadot

Polkadot  Bittensor

Bittensor  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Mantle

Mantle  Render

Render  Cosmos Hub

Cosmos Hub  Filecoin

Filecoin  Algorand

Algorand  Arbitrum

Arbitrum  Quant

Quant  Jupiter

Jupiter  Celestia

Celestia  Injective

Injective  Stacks

Stacks  Optimism

Optimism  Sei

Sei  Immutable

Immutable  The Graph

The Graph  Pyth Network

Pyth Network  THORChain

THORChain  Flow

Flow  MultiversX

MultiversX  dYdX

dYdX  Akash Network

Akash Network  Metis

Metis  Manta Network

Manta Network  Illuvium

Illuvium  Dymension

Dymension  Kujira

Kujira