The rise and fall of a crypto billionaire

Sam Bankman-Fried was once one of the most influential and wealthy figures in the cryptocurrency world. He founded FTX, a crypto exchange that was valued at $32 billion in early 2022, and Alameda Research, a crypto hedge fund that made him millions of dollars a day. He was also a philanthropist who donated millions to effective altruism causes and political campaigns. He had celebrity endorsements from Tom Brady, Gisele Bündchen, and Larry David, and he hobnobbed with former world leaders like Tony Blair and Bill Clinton.

But his empire came crashing down in November 2022, when FTX went bankrupt and $8 billion in customer funds went missing. He was arrested and charged with fraud and money laundering, accused of lying to investors and lenders and using FTX funds for his personal benefit. He pleaded not guilty and went on trial in New York, where he faced up to 110 years in prison if convicted.

The verdict that shocked the crypto world

On February 20, 2024, after a month-long trial and less than five hours of deliberations, the jury delivered its verdict: guilty on all seven counts. Bankman-Fried stood in front of the jury with his hands clasped as the verdict was read, while his parents sat with their heads in their hands. His sentencing was set for March 28, 2024.

The verdict sent shockwaves through the crypto community, which had followed the trial closely and hoped for Bankman-Fried’s acquittal. Many crypto enthusiasts saw him as a visionary who had pushed the boundaries of innovation and regulation in the industry. Some even launched a campaign to free him, using the hashtag #FreeSam on social media and petitioning President Biden to pardon him.

But the prosecution painted a different picture of Bankman-Fried, portraying him as a greedy and dishonest schemer who had perpetrated one of the biggest financial frauds in American history. They presented evidence that he had used FTX customer deposits to repay Alameda lenders, buy property, make investments, and donate to political causes. They also showed that he had lied to regulators and banks about the nature and source of his funds, and that he had manipulated the prices of crypto assets to benefit his own trading positions.

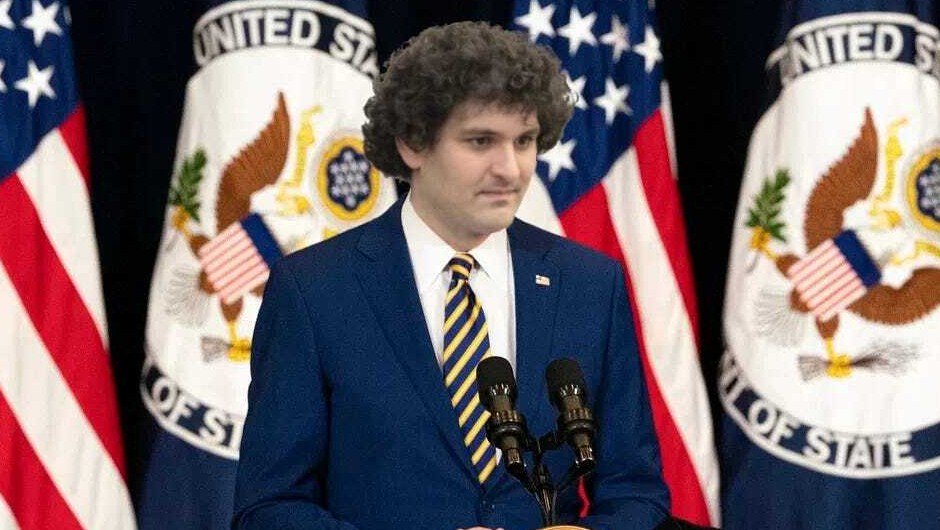

The first photo of Bankman-Fried in jail

While Bankman-Fried awaits his sentencing, he is being held at the Metropolitan Detention Center in Brooklyn, a notorious federal jail that has been plagued by poor conditions and abuse. He has been there since his arrest in November 2022, and has not been seen in public since then.

But on February 21, 2024, a crypto influencer named Tiffany Fong posted what she claimed was the first photo of Bankman-Fried in jail, posing with his fellow inmates. She said she got the photo from a man named G Lock, a former gang member who was in prison with Bankman-Fried. She also shared some details about his life behind bars, saying that he was known as “Gangster Sam” and that he was “weird as shit” but “a good guy”.

The photo showed a shaggy-haired and bearded Bankman-Fried wearing a blue prison jumpsuit and a white mask, standing next to two men who appeared to be members of the Bloods gang. He had a faint smile on his face and a peace sign on his hand. The photo quickly went viral on social media, sparking mixed reactions from his supporters and detractors.

Some expressed sympathy and admiration for Bankman-Fried, saying that he looked happy and resilient despite his situation, and that he had made friends with his cellmates. Others mocked and criticized him, saying that he looked pathetic and ridiculous, and that he had betrayed his customers and the crypto community.

The future of FTX and crypto regulation

The fate of FTX, the crypto exchange that Bankman-Fried founded and ran, remains uncertain. After its bankruptcy, FTX was taken over by a court-appointed trustee, who is in charge of recovering and distributing the missing funds to the creditors and customers. The trustee has been working with regulators and law enforcement agencies to trace and seize the assets that Bankman-Fried allegedly transferred or hid from FTX. The trustee has also been negotiating with potential buyers who are interested in acquiring FTX and its technology.

The collapse of FTX and the conviction of Bankman-Fried have also raised questions about the regulation and oversight of the crypto industry, which has been largely unregulated and decentralized. Some lawmakers and regulators have called for more stringent rules and enforcement to protect investors and consumers from fraud and abuse. They have also warned that the crypto market poses risks to the financial stability and national security of the US and other countries.

But some crypto advocates and experts have argued that more regulation is not the answer, and that it would stifle innovation and growth in the industry. They have also pointed out that the crypto market is diverse and dynamic, and that not all crypto businesses and actors are like FTX and Bankman-Fried. They have urged for a more balanced and nuanced approach to regulation, that would foster trust and transparency without compromising freedom and creativity.

Bitcoin

Bitcoin  Ethereum

Ethereum  Solana

Solana  Cardano

Cardano  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Polkadot

Polkadot  Mantle

Mantle  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Render

Render  Filecoin

Filecoin  Aptos

Aptos  Arbitrum

Arbitrum  Jupiter

Jupiter  Sei

Sei  Stacks

Stacks  Injective

Injective  The Graph

The Graph  Pyth Network

Pyth Network  Celestia

Celestia  Optimism

Optimism  THORChain

THORChain  Immutable

Immutable  MultiversX

MultiversX  Akash Network

Akash Network  dYdX

dYdX  Flow

Flow  Illuvium

Illuvium  Manta Network

Manta Network  Kujira

Kujira  Metis

Metis  Dymension

Dymension