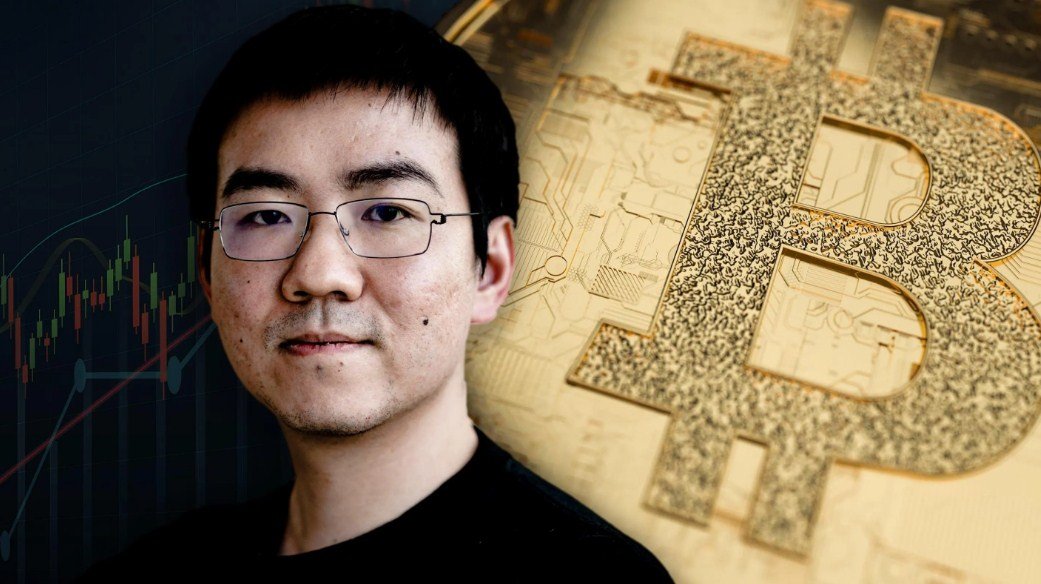

The founder of Matrixport and former CEO of Bitmain, Jihan Wu, has defended his company’s controversial report that predicted the rejection of spot Bitcoin ETFs by the U.S. regulators and caused a massive sell-off in the crypto market.

Matrixport’s Report Sparked Panic Among Investors

On December 24, 2023, Matrixport, a crypto financial services platform, published a report titled “Spot Bitcoin ETFs: A Pipe Dream?” that analyzed the prospects of the approval of spot Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC). The report concluded that the chances of such approval were very low, citing various legal, regulatory, and technical challenges.

The report also claimed that the SEC had already communicated its negative stance to some of the spot ETF applicants, and that an official announcement of the rejection was imminent. The report advised investors to prepare for a possible market crash, as the news would likely trigger a wave of panic selling and liquidations.

The report quickly spread across the crypto community and media, causing fear and uncertainty among investors. Many analysts and experts criticized the report for being based on speculation and rumors, and accused Matrixport of spreading FUD (fear, uncertainty, and doubt) to manipulate the market. Some even suggested that Matrixport had ulterior motives, such as shorting the market or promoting its own products.

The crypto market reacted negatively to the report, as the prices of Bitcoin and other major cryptocurrencies plunged by more than 10% in a matter of hours. The total market capitalization of the crypto space dropped by more than $100 billion, reaching its lowest level since October 2023.

Jihan Wu Stands by His Company’s Analysis

In an interview with Bloomberg, Jihan Wu defended his company’s report and said that it was based on thorough research and credible sources. He said that Matrixport had consulted with lawyers, regulators, and industry insiders, and that the report reflected the reality of the situation.

Wu also denied any allegations of market manipulation or conflict of interest, and said that Matrixport had no intention of causing harm to the crypto industry or investors. He said that the report was meant to inform and educate the public, and to help them make rational decisions based on facts and data.

Wu also said that he was still bullish on the long-term prospects of Bitcoin and the crypto space, and that he believed that spot ETFs would eventually be approved, albeit not in the near future. He said that the crypto industry needed to work together to overcome the regulatory hurdles and to foster innovation and adoption.

The Crypto Market Shows Signs of Recovery

Despite the initial shock and panic, the crypto market has shown some signs of recovery in the past few days. The prices of Bitcoin and other major cryptocurrencies have bounced back from their lows, and the total market capitalization has regained some of the lost ground.

Some analysts and experts have attributed the recovery to the resilience and optimism of the crypto community, as well as the absence of any official confirmation or denial of the spot ETF rejection by the SEC. Some have also pointed out that the spot ETF report was not the only factor that influenced the market, and that other macroeconomic and geopolitical factors also played a role.

The crypto market is still facing significant volatility and uncertainty, as the fate of the spot ETFs remains unclear. The SEC has not yet made any public statement regarding the matter, and the deadline for its decision on some of the applications is approaching. The crypto community and investors are eagerly awaiting the outcome, hoping for a positive surprise that could boost the market sentiment and confidence.

Bitcoin

Bitcoin  Ethereum

Ethereum  Solana

Solana  Cardano

Cardano  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Polkadot

Polkadot  Mantle

Mantle  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Cosmos Hub

Cosmos Hub  Quant

Quant  Algorand

Algorand  Aptos

Aptos  Filecoin

Filecoin  Render

Render  Arbitrum

Arbitrum  Jupiter

Jupiter  Sei

Sei  Stacks

Stacks  Optimism

Optimism  Injective

Injective  Celestia

Celestia  The Graph

The Graph  Pyth Network

Pyth Network  THORChain

THORChain  MultiversX

MultiversX  Immutable

Immutable  Akash Network

Akash Network  dYdX

dYdX  Flow

Flow  Illuvium

Illuvium  Manta Network

Manta Network  Kujira

Kujira  Metis

Metis  Dymension

Dymension