As the crypto community gears up for the next Bitcoin halving, analysts are making bold predictions about the future value of this pioneering digital currency. CoinLedger, a prominent crypto tax service provider, has projected that Bitcoin could reach a staggering $360,000 one year after the 2024 halving event. This forecast is based on historical data from previous halvings, which have traditionally signaled the start of significant bull runs in the cryptocurrency market.

The Halving Effect on Bitcoin’s Value

The halving event, which cuts the reward for mining new blocks in half, is a feature written into Bitcoin’s code by its creator, Satoshi Nakamoto. This event occurs approximately every four years and has historically been a precursor to a substantial increase in Bitcoin’s price.

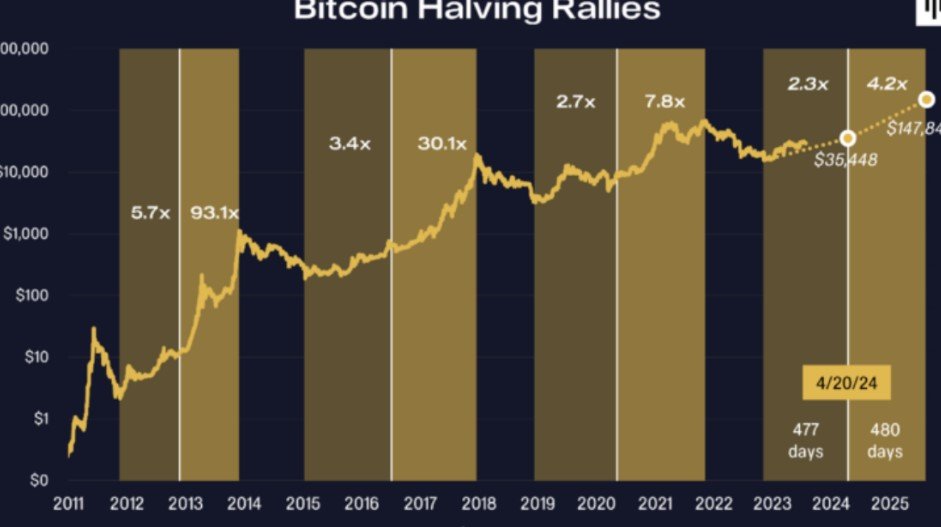

The anticipation of reduced supply and increased scarcity has typically led to a surge in demand, driving up the price. CoinLedger’s analysis of past events suggests that this pattern is likely to continue, with their prediction model indicating a potential 423% rise in Bitcoin’s value one year post-halving.

Historical Trends and Future Possibilities

Looking back at the 2012, 2016, and 2020 halvings, the price of Bitcoin saw remarkable increases in the following year. In 2012, the price skyrocketed from $12 to $1,003, marking an 8,000% increase. By 2016, the price reached $2,502, a 284% increase, and in 2020, it climbed further to $56,764, showing a 562% jump from its pre-halving price.

While past performance is not indicative of future results, these historical trends provide a basis for CoinLedger’s optimistic forecast. The prediction takes into account the average post-halving price increases observed in these years, setting the stage for what could be an unprecedented rise in Bitcoin’s price.

The Road Ahead: Bitcoin’s Journey to New Heights

As the 2024 halving approaches, the crypto world watches with bated breath. If CoinLedger’s predictions hold true, the next year could see Bitcoin’s value soar to new heights, potentially reaching $360,000. This would not only be a milestone for Bitcoin but also a testament to the enduring power of blockchain technology and the growing acceptance of cryptocurrencies as a whole.

The road ahead is fraught with uncertainties, but one thing remains clear: the halving event will be a critical moment for Bitcoin, possibly reshaping the financial landscape and solidifying its position as the leading digital asset.

Bitcoin

Bitcoin  Ethereum

Ethereum  Solana

Solana  Cardano

Cardano  Avalanche

Avalanche  Chainlink

Chainlink  Polkadot

Polkadot  NEAR Protocol

NEAR Protocol  Sui

Sui  Aptos

Aptos  Bittensor

Bittensor  Internet Computer

Internet Computer  Stacks

Stacks  Immutable

Immutable  Arbitrum

Arbitrum  Filecoin

Filecoin  Optimism

Optimism  Injective

Injective  Render

Render  Mantle

Mantle  Cosmos Hub

Cosmos Hub  THORChain

THORChain  The Graph

The Graph  Sei

Sei  Jupiter

Jupiter  Celestia

Celestia  Pyth Network

Pyth Network  Algorand

Algorand  Quant

Quant  Beam

Beam  Flow

Flow  dYdX

dYdX  MultiversX

MultiversX  Akash Network

Akash Network  Dymension

Dymension  Manta Network

Manta Network  Metis

Metis  Illuvium

Illuvium  Kujira

Kujira