Bitcoin halving, a significant event within the cryptocurrency sphere, is poised to occur this April. This scheduled event, which happens roughly every four years, directly impacts Bitcoin’s supply by reducing the mining reward by half. Let’s delve into the broader effects of Bitcoin halving and explore how it affects miners, institutions, and the overall market.

The Historical Context

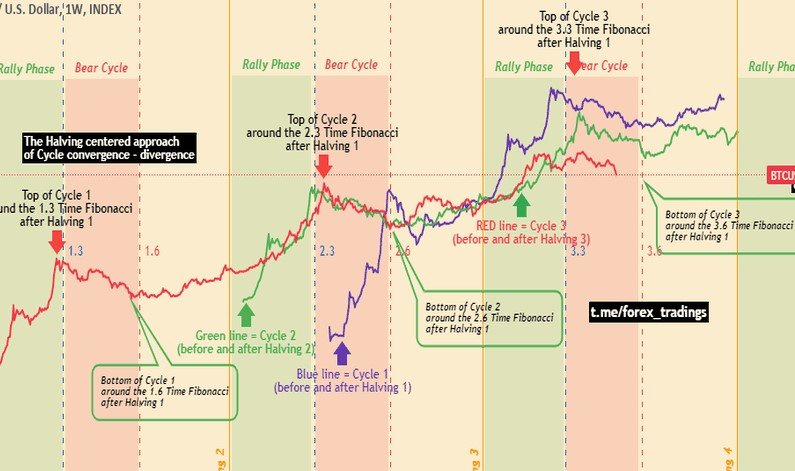

Bitcoin halving has historically influenced the cryptocurrency market. After the first halving in November 2012, Bitcoin’s price surged dramatically, increasing from $12 to $1,200. The second halving saw a 30-fold increase, from $650 to $20,000. The most recent halving resulted in an eight-fold rise, from $8,500 to about $19,500. While the multiple has decreased over time, the potential for growth remains.

Price Forecast and Market Impact

Considering previous post-halving rally cycles, we anticipate that Bitcoin will reach its next all-time high within 500 days to 18 months after this halving. If Bitcoin regains the $70,000 level by April 20, its value could exceed $300,000.

Miners and Investors

Bitcoin’s scarcity is essential for its function. The reduction in daily mined Bitcoin, from 900 to 450, poses challenges and opportunities for miners. When Bitcoin was around $40,000, most miners were profitable. However, the halving will test their resilience.

The Broader Implications

Beyond miners, Bitcoin halving reverberates throughout the crypto ecosystem. As the pioneering cryptocurrency, Bitcoin shapes the ethos and infrastructure of decentralized finance (DeFi). An increase in Bitcoin’s value could attract more investment into DeFi platforms and projects, fostering growth and adoption.

Bitcoin

Bitcoin  Ethereum

Ethereum  Solana

Solana  Cardano

Cardano  Avalanche

Avalanche  Chainlink

Chainlink  Polkadot

Polkadot  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Sui

Sui  Bittensor

Bittensor  Internet Computer

Internet Computer  Stacks

Stacks  Immutable

Immutable  Arbitrum

Arbitrum  Filecoin

Filecoin  Optimism

Optimism  Injective

Injective  Render

Render  Mantle

Mantle  Cosmos Hub

Cosmos Hub  THORChain

THORChain  The Graph

The Graph  Sei

Sei  Jupiter

Jupiter  Celestia

Celestia  Pyth Network

Pyth Network  Algorand

Algorand  Beam

Beam  Quant

Quant  Flow

Flow  dYdX

dYdX  MultiversX

MultiversX  Akash Network

Akash Network  Dymension

Dymension  Manta Network

Manta Network  Metis

Metis  Illuvium

Illuvium  Kujira

Kujira